- Home

- /

- PowerWash Industry

- /

- The Small Business Health Care Tax Credit Could Help Your Pressure Washing Business Save Big Money!

Subscribe To Our Newsletter

Stay in the know on the latest products, deals, events, tips & tricks.

Social Media

The Small Business Health Care Tax Credit Could Help Your Pressure Washing Business Save Big Money!

With all of the discussion about whether or not the Affordable Care Act (a.k.a. Obamacare) is good for our country, you might have missed one of the benefits to small businesses: a tax credit for companies that pay for their employees’ health care. This small business health care tax credit is great for our industry, known for small crews: the fewer employees you have, the better the tax credit.

According to the IRS website, for tax years 2010-2013, small businesses (fewer than 25 employees) can receive a maximum credit of 35 percent of health insurance premiums paid. For tax years 2014 and on, the maximum credit is 50 percent. The small business health care tax credit is available to eligible employers “for two consecutive taxable years.” For 2014, you must pay insurance plan premiums purchased through the Small Business Health Options Program (SHOP) Marketplace or qualify for an exemption to be eligible.

Unfortunately, as most things tax related, figuring out if you qualify for the small business health care tax credit is, well, complicated. First, the credit is based on the average income earned by full time employees. You can add together part-time employees to create an average based on full-time wages. For example, if you have 10 part-time employees, you add up their income and divide by 5. According to BloombergBusiness.com, “the credit applies fully to companies with 10 or fewer full-time employees who earn on average below $25,000. It phases out as the number of employees rises to 25 and wages go up to $50,000.”

You also need to pay a “uniform” 50% or more toward employee, self-only health insurance premiums. As previously mentioned, for 2014 and onward, plans must be purchased through SHOP marketplace for your state. SHOP helps small businesses get better coverage by pooling them together for higher purchasing power, plus it makes dealing with insurance easier – fewer administration woes, less time spent on it.

Before you grab your calculator, or add more hours to your accountant’s 2014 tax efforts, go to https://www.healthcare.gov/shop-calculators-taxcredit/ for a preliminary check on your eligibility. You can estimate total wages but you will need to know how much you paid in premiums. The actual paper work is much more complicated than filling out five blanks on an online form. You need to send Form 8941 completed with your tax documents. (Here is the instruction form, in case you need it.) As a result, only a small percentage of employers have bothered filing for the small business health care tax credit.

The Government Accounting Office found that 170,300 employers claimed the tax credit in 2012 out of 4 million eligible small businesses, as reported in usatoday.com. Many business owners don’t know about the small business health care tax credit and those who do find filing for it cumbersome at best, or simply not worth the effort because the credit is too small. Those employers who shared their stories with usatoday.com prefer to give their employees a defined contribution and send them to the individual market place for health insurance.

The intention of the tax credit is to entice small businesses to use the SHOP marketplace, which will ultimately keep insurance premiums low for everyone. With a complicated process to qualify, that may not happen.

Still, if you find you could qualify and you decide to apply, you are not penalized if you are turned down. Other than the time it took for fill out the form.

Share This Post

More To Explore

Beat the Heat: Summer Safety Tips for Power Washing Professionals

Protect Your Crew. Protect Your Equipment. Protect Your Business. When the summer sun blazes, pressure washing jobs don’t stop—but the ...

Soft Wash Additive That Smells Amazing? Meet Fresh Wash

Freshen Up Every Wash Soft washing is all about precision, power, and presentation — and nothing completes a job like ...

Mastering the Art of Pressure Washing: Key Insights on Surface Cleaners

For professionals in the pressure washing industry, a surface cleaner is an indispensable tool, particularly for those who specialize in ...

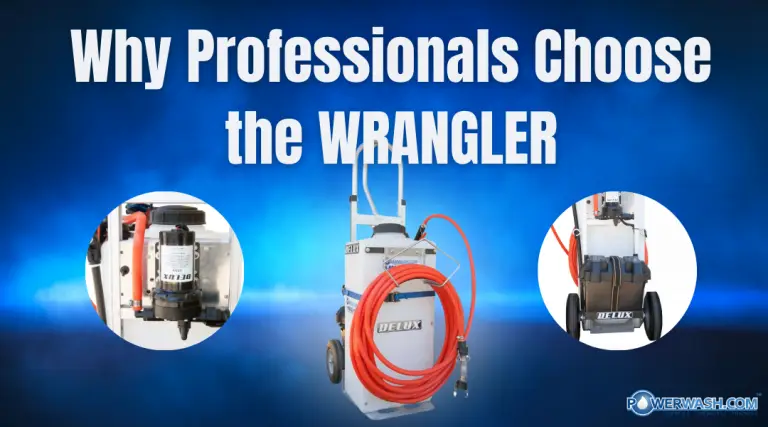

The Wrangler™ Chemical Sprayer: The Ultimate Tool for Professional Cleaning Applications

For commercial cleaners and pressure washing professionals, efficient chemical application is key to achieving the best results. The Wrangler™ Chemical ...